Top Tips for Choosing the Best Health Insurance for Your Family

Take outs:

- Family cover provides quicker access to private healthcare for all family members, reducing wait times and covering costs for treatments, physiotherapy, and hospital stays.

- Family policies can help reduce out-of-pocket costs and may offer tax benefits, such as avoiding the Medicare Levy Surcharge (MLS) and qualifying for the Private Health Insurance Rebate based on household income.

- It’s important to assess your family’s healthcare needs, including Hospital and Extras Cover, and compare policies for limits, excesses, and potential gaps. Ensure coverage extends to all dependants.

Top Tips for Choosing the Best Health Insurance for Your Family

Kids keep you on your toes with their adventurous spirit, boundless energy, and endless curiosity. But sometimes, this means you might find yourself more familiar with the local emergency room than you'd like. That’s where having private health insurance for your family can make a real difference when you need it most. We all want what's best for our kids, and when they’re sick or injured, this means quicker access to medical treatment, specialist consultations, and even private hospital rooms. It also helps reduce wait times that might occur in the public system and covers out-of-pocket expenses for treatments, physiotherapy, or ongoing care needed after an injury.

Since child-only health insurance is not widely available, many parents opt for Family cover to ensure the entire household is protected against injuries and illnesses. However, Family health insurance policies can vary significantly in price, so it’s important to shop around for the best deal.

Here’s what you need to consider when choosing the best health insurance for families in Australia.

What is Family cover?

Family cover is a health insurance policy that covers the healthcare costs of 2vadults and any children living under the same roof, including step-children, adopted children, and foster children.

If you’re a single parent, you’ll need a Single Parent policy instead.

You don’t have to wait until you have children to get a Family policy. In fact, it’s a smart idea to take out Family cover before starting a family, ensuring that your children are covered from birth. This could save you thousands if your newborn requires private hospital treatment.

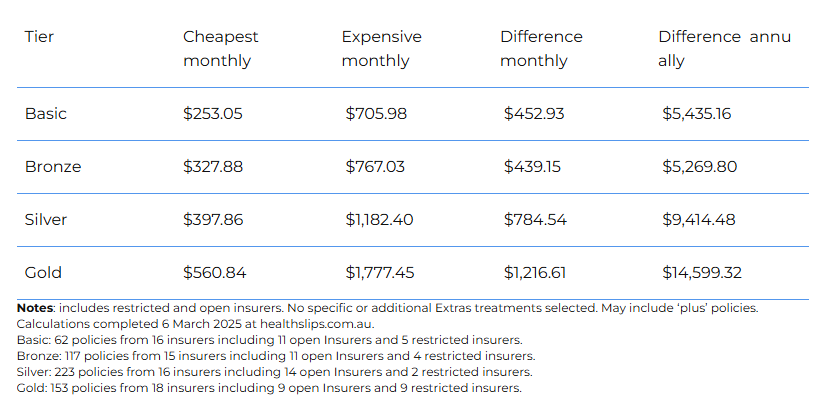

We used the healthslips.com.au calculator to run the numbers, as it compares every policy from every insurer—with no commercial bias and free, open access to results. In the table below, you'll see a clear example: when we calculated the cheapest Family policy in Queensland, the price range for Family health cover varied significantly.

Image credit: Combined Hospital and Extras Cover in QLD, excess up to $750, including open and restricted insurers. Healthslips.com.au.

https://www.healthslips.com.au/blog/what-is-the-best-health-insurance-for-aussie-families

What are the benefits of Family cover?

Having Family health insurance provides peace of mind, knowing that if you, your partner, or your children need hospital treatment, they can receive private care quickly. You’ll have the option to choose doctors and are more likely to secure a private hospital room. This can be especially advantageous if your child needs surgery, such as a tonsillectomy, which has an average waiting list of 121 days. With private health insurance, they can receive treatment sooner at a private hospital.

If you opt for Extras Cover, all family members will be covered for certain non-hospital treatments, like dental care, glasses, physiotherapy, and speech therapy.

A key benefit of family policies can be the ability to share the limit across all members, which can be helpful if one person has higher needs in a specific area, such as orthodontic treatments.

There may also be financial benefits to having private health insurance. If your family income exceeds $194,000, Hospital Cover can help you avoid the Medicare Levy Surcharge (MLS) at tax time.

Additionally, if your household income is $302,000 or less, you might qualify for the Private Health Insurance Rebate, which can reduce your premiums by up to 32.385%. This income threshold increases by $1,500 for each child after the first, so it’s a good idea to check your eligibility for the Rebate.

Choosing the best health insurance for your family

The first step in choosing the best health insurance for your family is to assess your budget and determine the types of healthcare coverage you need. Consider whether you require Hospital Cover, Extras Cover, or both. For instance, if you want cover for hospital visits, you’ll need Hospital Cover. If you’re seeking dental coverage for your children’s appointments, you’ll need Extras Cover. For ambulance treatment and transport, both Hospital and Extras Cover typically include this, or you could choose standalone Ambulance Cover. The length of time your children will be covered varies by insurer. Some insurers cover dependants up to the age of 31 if they are single, but if they’re not in full-time study, this may increase your premium. Be sure to check with your insurer for their criteria regarding adult dependants.

Is ambulance treatment free in your state?

What is a Gap?

When reviewing policies for you, your partner, and your children, it’s important to check the policy limits, excesses, and gaps. Some insurers offer no excess for children, while others provide no-gap dental policies for kids.

What is the difference between Hospital and Extras Cover?

Compare your health insurance policy with others on the market, or calculate a new policy.

- - -

This article was inspired by the article from Kelly+Partners client, healthslips.com.au, a platform that allows Australians to compare every health insurance policy from every health insurer. The service provides a comparison of all available policies across Australia, offering tools such as calculators to determine the cost of a new policy, compare existing policies, and calculate the Government Rebates, age-based Discounts, and Lifetime Health Cover Loading.

https://www.healthslips.com.au/blog/what-is-the-best-health-insurance-for-aussie-families

If you would like to discuss your insurance needs, please get in touch today.

Share this

You May Also Like

These Related Stories

Louise Cordina - Running a Family Business | Be Better Off Show Podcast

Brett Lee - Representing Australia in Cricket and Business | Be Better Off Show Podcast

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)