How Simple Protocols Are Making Crypto Accessible for Everyone

Take outs

- Decentralised Finance (DeFi) eliminates intermediaries, offering a faster, more accessible, and open version of traditional finance. It allows anyone with an internet connection to lend, borrow, trade, and invest in digital assets securely, transparently, and 24/7.

- Platforms like Uniswap and SushiSwap make it easy for users to join and leave liquidity pools, earning a share of the trading fees. These platforms are user-friendly, allowing anyone to participate without advanced technical skills.

- DeFi ensures transaction confidentiality through technologies like zero-knowledge proofs, allowing users to participate in financial activities without sharing personal details, enhancing privacy and security for all.

Decentralised Finance (DeFi) for the Masses: How Simple Protocols Are Making Crypto Accessible for Everyone

Traditional finance has always been complex, with multiple steps, significant paperwork, and high fees. Managing investments often feels like navigating through a maze. However, there is a new system called Decentralized Finance (DeFi) that aims to simplify the process by eliminating the unwanted interference of middlemen. It acts as a bridge, allowing for seamless peer-to-peer transactions.

Revolution of finance: DeFi

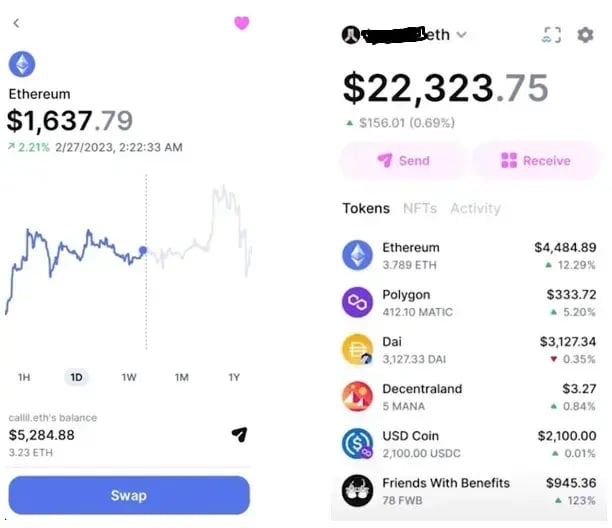

Decentralised Finance, or DeFi, is a faster, more accessible, and open version of traditional finance. It allows anyone with an internet connection to lend, borrow, trade, and invest in digital assets without relying on intermediaries. DeFi transactions are secure, transparent, and available 24/7. This revolutionises our approach to finance and makes it more inclusive. Additionally, DeFi platforms enable micro-transactions, making it accessible to a wider audience.

Role of DeFi Protocols

DeFi platforms such, as Uniswap and SushiSwap are leading the way in the DeFi world allowing individuals to trade cryptocurrencies directly without any middlemen.

Uniswap operates on the Ethereum blockchain with an automated market maker (AMM) system, where liquidity providers contribute funds to pools and earn fees in return. Its user-friendly interface makes it easy for users to swap tokens, list new ones, or provide liquidity to earn fees.

SushiSwap, based on Uniswap's model, enhances the experience by offering additional features like staking and yield farming to reward users. With its AMM system, SushiSwap incentivises liquidity providers by allowing them to stake their assets and earn rewards in the form of its native token, SUSHI.

Simplifying Liquidity Pool

Uniswap and SushiSwap make it easy for users to join and leave liquidity pools. Anyone can add token pairs to a pool, enabling trades on the platform. In return, they earn a share of the trading fees. For those wanting to exit, users can withdraw their tokens and any accrued fees at any time. This accessibility allows anyone to participate without needing advanced technical skills.

Cloak of Anonymity

Privacy is essential in DeFi, with technologies like zero-knowledge proofs allowing participation in financial activities without sharing personal details. This ensures transaction confidentiality and security. Whether you’re making a large investment or transferring assets, your activities remain private.

DeFi has evolved from an innovative concept into a tangible reality, offering user-friendly applications for everyone. Decentralised exchanges, lending platforms, and yield farming opportunities are reshaping finance, promoting fairness and accessibility. Whether you're new to cryptocurrencies or a seasoned enthusiast, DeFi is revolutionising the financial landscape, making it inclusive and accessible for all.

If you would like to discuss your cryptocurrency needs, please get in touch today.

Share this

You May Also Like

These Related Stories

Understanding DeFi Taxes in Australia

Likes, Shares, and Blockchain: The Social Media Impact on Crypto Adoption

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)