History of Alternative Investments

Take outs:

-

Alternative investments have gained significant traction over the last 20 years, particularly among institutional and family portfolios, facilitated by private banks and wealth management firms.

-

The origins of alternative investments date back over 170 years, with the first notable private capital investment occurring in 1852 with the construction of America’s First Transcontinental Railroad.

-

Historical records of commodity trading (e.g., precious metals, spices) and events like the Tulip Bulb craze in the 1600s show that alternative investments are not a modern concept.

- Over the past 45 years, the alternative investment landscape has expanded significantly, with diverse product offerings and strategies emerging.

History of Alternative Investments

Alternative investments have significantly risen in popularity over the last 20 years as more market participants gain access to private market investments via Private Banks and Wealth Management Firms. Although Alternatives are now commonplace in both institutional and family portfolios, the history of the category stretches back over 170 years.

The first example of private capital investment was made in 1852 with America’s First Transcontinental Railroad, a 1911 mile stretch that connected the existing eastern US rail networks with the pacific coast. The rail was built by three private companies over public lands and represented the first global example of private infrastructure.

In 1901, the first leveraged buyout was completed by J.P. Morgan when it acquired the Carnegie Steel Company and in 1946 the first Venture Capital funds were formed by American Research and Development Corporation and J.H. Whitney & Co. 1949 brought about the formation of the world’s first Hedge Fund developed by Alfred Winslow Jones whose strategy was to create a market neutral portfolio by separating out the risk factors in the market and specific equities. Jones achieved market neutrality by buying assets he believed would rise in value relative to the overall performance of the market, and selling short assets whose price he expected to decrease. Whilst these were the first examples of more formalized private market investments, there are historical records that stretch as far back as 4500 BC for commodity trading (precious metals and spices) and the notorious Tulip Bulb phenomenon of the 1600’s where bulbs sold for as much as 6 times the average annual salary of the time. Real Estate, which does classify as an alternative investment, stretches back to the dawn of humanity making the category far from “new”.

The post World War II era created a significant catalyst for private capital investment as nations began to rebuild from the devastation caused by the war. As private capital began to join government capital in various parts of the economy, new asset classes were born such as Private Equity, Venture Capital, Infrastructure, and Private Credit. Following the stock market crash of 1974, regulatory changes allowed pension funds to invest in “riskier” options and a reduction in the capital gains tax to aid the recovery caused a significant amount of inflow in private equity investments. The 1980’s saw a boom in leveraged buyouts causing private equity holdings to begin to appear in the portfolios of mainstream investors. In 1966, Fortune Magazine revealed the strategy that Alfred Winslow Jones had used with his market neutral fund commenting on the strategy’s significant outperformance over the best mutual fund over the prior 5 years. This caused the hedge fund industry to boom and by the early 1980’s there were an array of new funds and strategies available on the market.

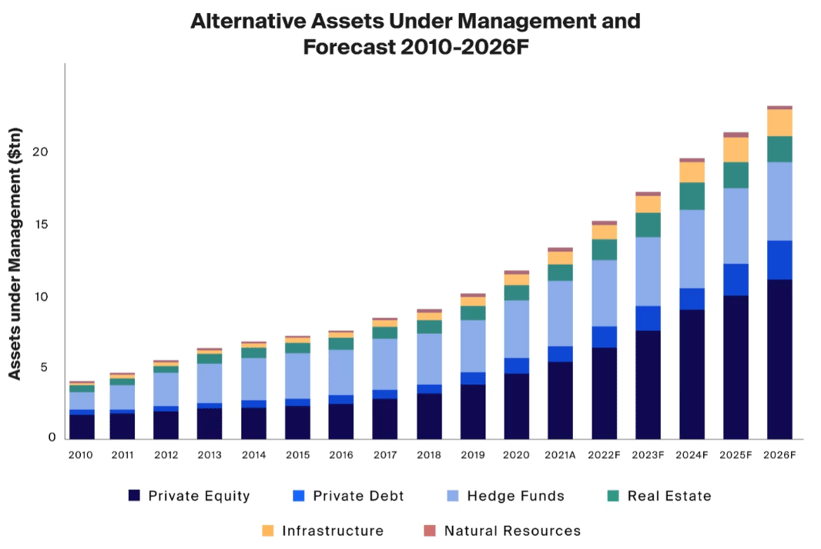

Alternative Assets Under Management is anticipated to continue to grow over the next few years. (Source: CAIS)

Over the past 45 years, we have seen a continually evolving marketplace for alternatives with both the depth and breadth of product offerings continuing to deepen. The adoption of alternatives by both the Harvard and Yale endowments has pioneered modern thinking about allocation to the asset class and has guided more involvement from family offices and private investors who look to gain access to the attractive risk / return opportunities available.

Kelly+Partners Private Wealth provides our wholesale clients access to select group of top quartile Australian and global alternative asset managers across multiple asset classes to solve for both growth and income requirements.

If you would like to learn more about investing into alternative investments, book a discovery session below.

Share this

You May Also Like

These Related Stories

THE SEARCH FOR YIELD – What are my investment options?

Introducing Kelly+Partners BlueCore Model Portfolios

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)