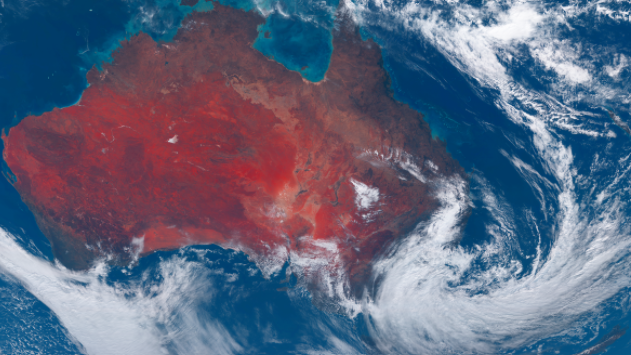

Capital Battle: Australia's Bridesmaid States are Booming

Take outs:

-

The pecking order of Australia’s capital cities is being re-written as buyers flock to sunny second-string capitals, driving record price peaks. Brisbane has surpassed Melbourne and Canberra to become Australia’s second most expensive city.

-

The ongoing demand for affordable housing and lifestyle options is influencing the real estate dynamics across Australia, reshaping the capital cities' rankings and property values.

Australia's bridesmaid states are booming as Brisbane overtakes Melbourne and Perth soars

The pecking order of Australia’s capital cities is being re-written as buyers flock to sunny second-string capitals, driving record price peaks.

Brisbane has now overtaken Canberra and Melbourne to claim the title of Australia’s second most expensive city behind Sydney, with a median home value of $840,000, according to the PropTrack Home Price Index for June.

Meanwhile, Perth – still only sixth on the list of the country’s most expensive capitals – is gaining ground fast, posting the fastest annual price growth in the country. In the past year, median dwelling values in the West Australian capital have leapt 22.5 per cent, going from around $577,000 in June 2023 to hit an all-time high of $713,000 in June this year.

That outstrips growth in its nearest rivals Adelaide, up 14.6 per cent in the past year, and Brisbane, up 14.1 per cent. Sydney remained the country’s most expensive city to buy a home, with solid annual growth of 6.4 per cent across all dwellings.

One of the most interesting pictures to come out of the recent PropTrack data update is the stark divide opening up around the country, with sustained strong growth in Perth, Adelaide and Brisbane, while many other capitals remain flat or fall back.

In the past year, median values in Melbourne dropped marginally, by 0.07 per cent, while in Hobart there was a more marked annual decline of 2.06 per cent. The Tassie capital, which posted incredible gains during Covid years, is now down nearly 10 per cent on its 2022 highs.

*Due to its limited geography, dominated by Canberra, median dwelling price is reported as a whole for ACT.

Source: PropTrack Home Price Index June 2024

Taking a longer-term view, median dwelling values in capital cities in WA, Queensland and South Australia have all climbed around 70 per cent in the past four years. Not only is it an incredible gain, but it’s roughly double the rate of price growth recorded in other State capitals during the same period, perhaps reflecting demand for more affordable, lifestyle properties.

The most recent population data from the Australian Bureau of Statistics backs this, with Brisbane and Perth the only capitals to gain population through internal migration from other States and regions in 2022/23. All other capital cities gained overseas migrants but lost existing residents, who either moved interstate or to regional centres within the same State.

While the total populations of Melbourne and Sydney grew strongly throughout the 2022/23 financial year, according to the ABS insights this increase was overwhelmingly fuelled by overseas migration.

During 2022/23 about 38,400 existing residents left Melbourne to move interstate or to regional Victoria, while during the same period about 15,300 people moved to Brisbane and about 10,700 moved to Perth from other parts of Australia.

With some of Australia’s traditionally more affordable capitals facing increasing price pressures, real estate experts at Oxford Economics Australia have predicted unit prices, which have lagged behind houseprice growth, will pick up and even outpace housing growth in some centres as buyers chase value.

The Oxford Economics Residential Property Prospects Report also predicted Perth would continue to be the country’s standout real estate performer through to 2027, with a strong economy underpinning price growth. The report forecast Darwin, which has underperformed in recent years, would pick up, with housing and unit growth tipped to average 7-8 per cent through 2025 and 2026.

Share this

You May Also Like

These Related Stories

Harry Triguboff - Learn from Australia's Richest Man | Be Better Off Show

How to plan and prepare for floods during Australia's East Coast Low

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)