Presidential Candidates on Taxes

Takeaways:

-

Regular physical activity can significantly reduce stress and improve mood, contributing to better mental health among employees. Simple initiatives like short walks or group workouts can make a positive impact.

-

Exercise enhances cognitive function and creativity, allowing employees to return to work with renewed focus and energy, leading to higher productivity and efficiency.

-

Engaging in shared physical activities fosters stronger relationships and collaboration among colleagues, enhancing overall team dynamics.

-

Promoting employee fitness can lower healthcare expenses related to chronic conditions, benefiting both employees and employers through healthier lifestyles and reduced medical costs.

KAMALA HARRIS (D)

Kamala Harris has announced new tax and economic policies as part of her campaign platform, including exempting tip income from taxation; expanding the child tax credit, earned income tax credit, and premium tax credits; and implementing new tax incentives for housing. She may continue the same policies put forth in the FY 2025 budget of the Biden-Harris administration or may propose additional tax policy changes.

|

Business Taxes |

|

|

Capital Gains and Dividend Taxes |

|

|

Credits, Deductions, and Exemptions |

|

|

Estate and Wealth Taxes |

|

|

Excise Taxes |

|

|

Individual Income Taxes |

|

|

Payroll Taxes |

|

|

Tariffs and Trade |

|

|

Other |

|

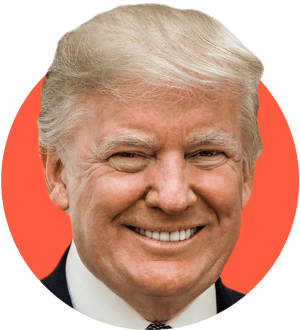

DONALD TRUMP (R)

Donald Trump would impose a universal baseline tariff on all US imports, impose a 60 percent tariff on all US imports from China, make the individual and estate tax cuts of the TCJA permanent (potentially without reinstating the cap on itemized deductions for state and local taxes), lower the corporate income tax rate from 21 percent to 20 percent or 15 percent (potentially for domestic production only), tax large private university endowments, consider replacing the income tax with tariffs, exempt tip income from taxation, exempt Social Security benefits from taxation, and exempt overtime pay from taxation. Trump is considering expanding the child tax credit to a $5,000 universal credit.

|

Business Taxes |

|

|

Capital Gains and Dividend Taxes |

|

|

Credits, Deductions, and Exemptions |

|

|

Estate and Wealth Taxes |

|

|

Excise Taxes |

|

|

Individual Income Taxes |

|

|

Payroll Taxes |

|

|

Tariffs and Trade |

|

|

Other |

|

Share this

You May Also Like

These Related Stories

.png)

How do taxes affect business decisions?

When Trusts Follow You (or not) to Australia

.png)

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

%201.webp?width=1920&height=809&name=James%20Howard%20Building%201%20(1)%201.webp)