The Argument for National Cryptocurrency Reserves

Take outs:

- On January 23, 2024, U.S. President Donald Trump signed an executive order to create a cryptocurrency advisory council. This group will help shape U.S. digital asset policies, collaborate with Congress on crypto legislation, and work with agencies like the SEC and CFTC to advance a Bitcoin reserve proposal.

- Countries and institutions are increasingly holding Bitcoin as part of their reserves, similar to gold. Bitcoin is seen as a hedge against inflation, currency devaluation, and economic instability. Nations like El Salvador and the Central African Republic have even made Bitcoin legal tender to assert financial sovereignty.

- Corporations like MicroStrategy and Tesla, along with publicly traded companies and investment funds, are increasingly adding Bitcoin to their balance sheets. This highlights growing institutional confidence in Bitcoin as a store of value.

- The main risk of Bitcoin reserves lies in its volatility and the potential for geopolitical tension if large-scale accumulation by countries like the U.S. occurs. This uncertain future of Bitcoin as a stable asset could create systemic risks for global finance, with the possibility of destabilizing the broader economy if its value declines significantly.

The Argument for National Cryptocurrency Reserves

On 23 January 2024, U.S. President Donald Trump signed an executive order to create a cryptocurrency working group, fulfilling a campaign vow made after he won the backing of digital asset firms by positioning himself as a “crypto president.” The newly created crypto advisory council will be tasked with crafting digital asset policy, working with Congress on crypto legislation, helping to develop Trump’s proposed bitcoin reserve, and coordinating among the major agencies like the Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Treasury.

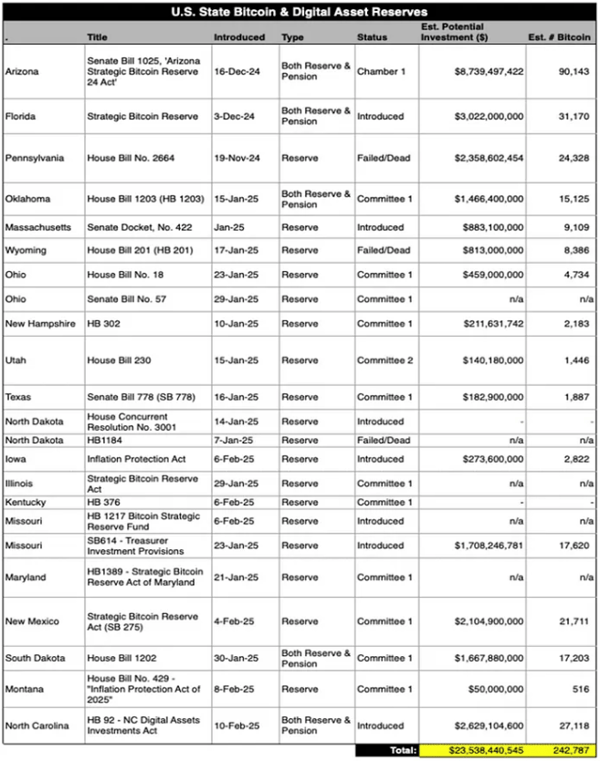

In recent months, legislators in states such as Massachusetts, Ohio, Texas, Illinois, North Carolina, and Florida have proposed bills establishing government reserves to invest in Bitcoin and possibly other cryptocurrencies.

Typically referred to as “digital gold,” Bitcoin is increasingly finding its way into the reserves of governments, businesses, and institutional investors. As foreign exchange reserves are traditionally made up of gold, the U.S. dollar, and other fiat currencies, there is an emerging trend of nations resorting to bitcoin as a strategic inflation hedge, economic uncertainty hedge, and geopolitical risk hedge.

Image Credit: Marketwatch (Matthew Sigel, VanEck)

What Are Bitcoin Reserves?

A strategic reserve refers to a stock of an essential resource that can be deployed during emergencies or supply shortages. The most prominent example is the U.S. Strategic Petroleum Reserve, the largest global stockpile of emergency crude oil. Canada has the world’s only strategic reserve of maple syrup, while China has strategic reserves of metals, grains and even pork products. Similar to how countries hold gold or foreign currency reserves, Bitcoin reserves are seen as a hedge against inflation, currency devaluation, and economic instability. The decentralized nature of Bitcoin, combined with its limited supply of twenty-one million coins, makes it an attractive alternative to traditional reserve assets.

Why Are Countries and Institutions Holding Bitcoin Reserves?

Hedge Against Inflation

With central banks worldwide printing money to stimulate economies, concerns about inflation and currency devaluation have grown. Bitcoin’s fixed supply makes it an appealing hedge against these risks.

Diversification of Reserves

Countries are diversifying their reserve portfolios beyond traditional assets like the US dollar, gold, and bonds. Bitcoin offers a non-correlated asset class that can reduce dependency on any single currency or commodity.

Technological Advancement

As blockchain technology gains traction, governments and institutions are recognizing the potential of Bitcoin and other cryptocurrencies to revolutionize financial systems. The global economy is undergoing a digital transformation, and Bitcoin represents a modern, digital form of wealth. As businesses and consumers alike adopt digital currencies, having Bitcoin reserves allows a country to be at the forefront of this transformation.

Financial Sovereignty

For some nations, holding Bitcoin reserves is a way to assert financial independence from global powers and reduce reliance on the US dollar-dominated financial system.

Volatility and Opportunity

While Bitcoin is known for its price volatility, this volatility can present opportunities for profit for savvy resource managers. Countries can strategically buy and sell Bitcoin to capitalize on favorable market conditions, enhancing their national reserves.

Economic Sovereignty

By holding Bitcoin, a country can promote its sovereignty over its financial future. This is particularly relevant for nations facing economic sanctions or isolation, creating a pathway to global financial integration.

Countries Leading the Bitcoin Reserve Trend

El Salvador

In September 2021, El Salvador made history by becoming the first country to adopt Bitcoin as legal tender. The government has actively purchased Bitcoin as part of its national reserves, with President Nayib Bukele announcing regular Bitcoin purchases. While the initiative has faced criticism and challenges, it has sparked global interest in the concept of national Bitcoin reserves.

Ukraine

Ukraine has emerged as a crypto-friendly nation, receiving millions of dollars in cryptocurrency donations during the Russia-Ukraine war. The government has also passed legislation to regulate and integrate cryptocurrencies into its financial system, indicating a potential move toward holding Bitcoin reserves.

Central African Republic (CAR)

Following El Salvador’s lead, the CAR adopted Bitcoin as legal tender in 2022. The country, which relies heavily on foreign currencies, sees Bitcoin as a way to strengthen its financial independence.

Other Nations Exploring Bitcoin Reserves

While not yet official, countries like Paraguay, Panama, and Venezuela have expressed interest in Bitcoin adoption or holding Bitcoin reserves. Additionally, nations with unstable currencies, such as Argentina and Türkiye, are seeing increased Bitcoin adoption among citizens, which could pave the way for government involvement.

Institutional Adoption of Bitcoin Reserves

Beyond nations, corporations and financial institutions are also building Bitcoin reserves:

MicroStrategy

The business intelligence firm has become one of the largest corporate holders of Bitcoin, with its CEO, Michael Saylor, advocating for Bitcoin as a superior store of value. As of 2023, MicroStrategy holds over 150,000 BTC.

Tesla

In early 2021, Tesla announced a $1.5 billion Bitcoin purchase, signalling corporate confidence in the cryptocurrency. Although the company later sold a portion of its holdings, it remains a significant player in the institutional Bitcoin space.

Publicly Traded Companies

Companies like Square (now Block), Marathon Digital Holdings, and others have added Bitcoin to their balance sheets as part of their treasury management strategies.

Bitcoin ETFs and Funds

The rise of Bitcoin exchange-traded funds (ETFs) and investment funds has made it easier for institutions to gain exposure to Bitcoin without directly holding the asset.

The biggest risk posed by a Bitcoin reserve

Strategic reserves exist to maintain stability and provide immediate access during crises. Nations hold reserves in dollars or oil to repay debts, fulfil cross-border obligations, and sustain essential operations when supply chains are disrupted. Despite its potential, bitcoin does not currently fulfil these urgent needs.

However, a greater concern looms. If the U.S. were to accumulate Bitcoin on a large scale, it could be interpreted as a hedge against its currency — potentially triggering an alarm and allowing geopolitical rivals like China or Russia to argue that the U.S. has lost confidence in the dollar.

Bitcoin’s long-term trajectory could be bright. It could grow into a universal settlement layer for nations wary of each other’s financial rails. But that transition is still unfolding. At present, the priority should be developing the infrastructure that enables Bitcoin and other cryptocurrencies to evolve from speculative assets into essential components of global finance. Stockpiling Bitcoin now may drive gains for early adopters and fuel speculation, but it provides little strategic value.

The anonymity of cryptocurrency transactions poses another challenge — tracking the origins of government bitcoin purchases would be difficult — criminals and hostile governments could be enriched from these purchases. Investors are already loading up on Bitcoin indirectly through regulated exchange-traded funds launched last year, which have pulled in more than $110bn. “Investors have gone from thinking it was a mistake to have a position on crypto to realising the mistake is not to have an outlook on bitcoin,” says Kristin Smith, chief executive of lobby group Blockchain Association.

Bitcoin has strayed from its original vision of creating an alternative financial system beyond government and corporate oversight. And now Bitcoin believers are cheering being accepted by arguably the biggest establishment of all — the US government.

Policymakers remain cautious. If major institutional investors, such as pension funds and central banks, begin holding Bitcoin and its value plummets, the consequences could ripple through the financial sector, potentially necessitating bailouts for struggling crypto firms.

The volatility of cryptocurrencies, combined with leverage and the risk of price crashes, means that as bitcoin becomes more mainstream, it could destabilize the broader financial system. The New York Federal Reserve has warned that this could create systemic risks with severe consequences for the real economy.

A collapse in crypto markets could have far-reaching effects on the U.S. and global economy, particularly if government holdings lose significant value, leading to concerns over poor investment decisions. There is also a risk of spillover effects in bond markets.

“The irony is striking,” notes Hilary Allen, professor at American University Washington College of Law. “Bitcoin was born out of a rejection of central banks and traditional finance, yet the fear now is that it could ultimately rely on support from the very institutions it sought to escape.”

If you would like to discuss your cryptocurrency needs, please get in touch today.

Share this

You May Also Like

These Related Stories

Digital Assets and Global Affairs: How Politics Drives Cryptocurrency Trends

Understanding Bitcoin’s 21 Million Cap

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)