Government Proposal: ATO interest charges to become non-deductible from 1 July 2025.

Government Proposal: ATO interest charges to become non-deductible from 1 July 2025.

24 April 2024

3

min read

Small Business Wellness: Your Stress-Busting Tips for Success

Small Business Wellness: Your Stress-Busting Tips for Success

24 April 2024

4

min read

Protect Your Retirement: 5 Costly Mistakes You Can't Afford to Make

Protect Your Retirement: 5 Costly Mistakes You Can't Afford to Make

24 April 2024

3

min read

The Case for Alternatives: Diversifying Portfolio Asset Allocation

The Case for Alternatives: Diversifying Portfolio Asset Allocation

23 April 2024

3

min read

How Much is My Business Worth?

How Much is My Business Worth?

22 April 2024

2

min read

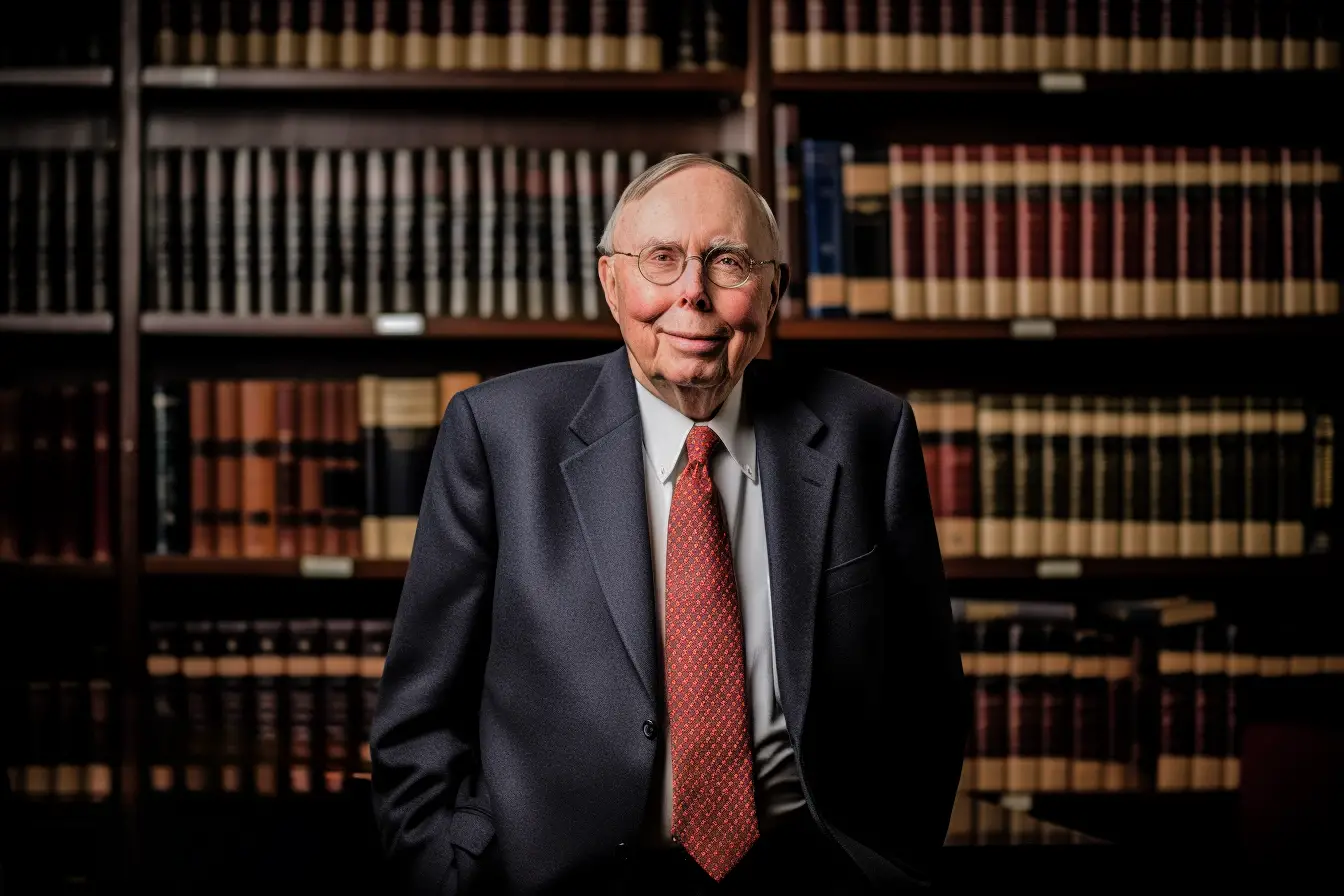

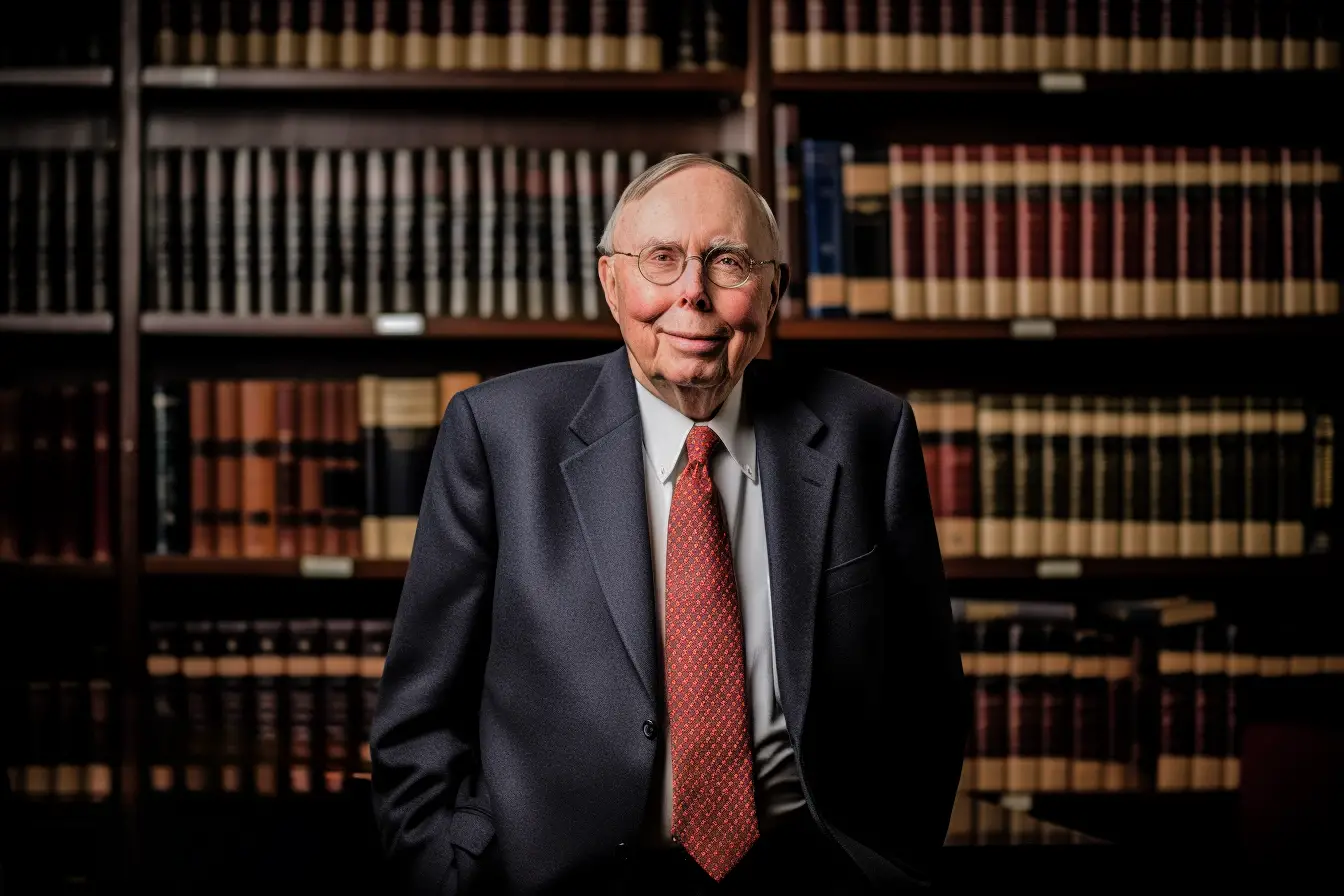

3 Investing and Life Lessons From the Late Great Charlie Munger

3 Investing and Life Lessons From the Late Great Charlie Munger

15 April 2024

3

min read

A Small Business Guide to Tax Planning

A Small Business Guide to Tax Planning

11 April 2024

2

min read

The ATO Debt Dilemma

The ATO Debt Dilemma

8 March 2024

2

min read

The Fringe Benefit Tax traps

The Fringe Benefit Tax traps

8 March 2024

4

min read

/Brand/Logos/Kelly%20Partners%20Accountants%20Logo/Kelly-Partners-Accountants-Horizontal-Logo.webp?width=1500&height=212&name=Kelly-Partners-Accountants-Horizontal-Logo.webp)

/Images/Industries/Automotive-Repairers-Mobile.webp?width=1120&height=1088&name=Automotive-Repairers-Mobile.webp)